The Real Britain Index (RBI) aims to provide a more accurate measure of the price rises that people face than is available in the government’s headline Consumer Price Index (CPI) measure of inflation.

There’s no such thing as «an average household»

The CPI is fundamentally flawed. It uses an average “basket of goods” to reflect typical consumption patterns, with price changes for each good and service weighted by the proportion the average household spends on it.

But there is no such thing as an average household. What households buy varies depending on who is in it and how rich they are. A key difference is that poorer households spend proportionately more on essential goods and services – housing, food and utilities – than the richest.

Because CPI is based on average for everyone, it ignores this effect. And with the prices of essentials rising so much in recent years, with food up 46% and gas and electricity 73% since 2005, this income effect matters.

RBI: a more accurate picture of inflation

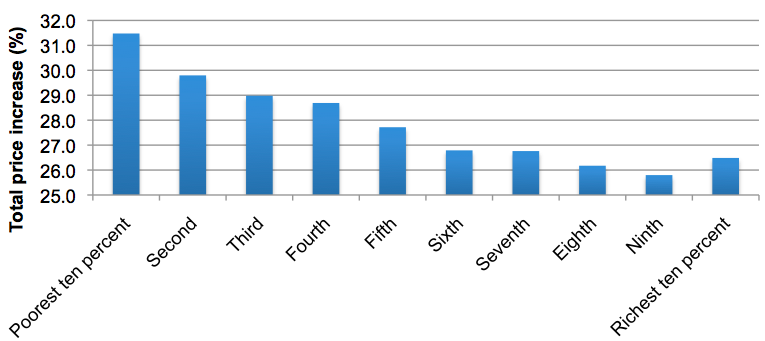

The RBI, based on research by the New Economics Foundation, addresses this imbalance by showing the real rate of inflation for each 10% income group in the country, sorted from poorest to richest. By looking at what different groups consume, we can come up with a better inflation figure for them.

RBI analysis reveals low earners have consistently faced higher inflation than CPI figures suggest:

Small differences in the rate of inflation add up over time. And the bias against the poorest is clear – while low earners struggle to afford basic essentials, the richest 10% experience a slightly higher rate largely on the basis of rising private school fees.

This bias would have been worse since 2006 if the period straight after the crash, from 2008-2010 had not seen a reverse in the usual inflation patterns, with the poorest suffering lower price increases than the richest.

Current inflation rates

Using the latest ONS figures, we estimate the real rate of inflation for each income group in September 2014 to be as below:

2011-2013| Poorest | 2nd | 3rd | 4th | 5th | 6th | 7th | 8th | 9th | Richest |

|---|---|---|---|---|---|---|---|---|---|

| 1.392 | 1.209 | 1.189 | 1.199 | 1.168 | 1.109 | 1.131 | 1.124 | 1.141 | 1.346 |

For the poorest in society, the CPI measure of inflation is understating the inflation they experience. For the rest, it is currently a closer measure of their experience, a result of their ability to substitute different expenditures.

Earnings aren’t keeping up

Even with these historically low rates of inflation, however, UK earnings have not kept pace with rising prices, meaning real incomes have fallen. As a result, standards of living across the population have slipped since 2008. The table below shows how incomes have changed for each 10% group since 2006, after taking account of taxes and benefits.

Changes to post-tax income, selected periods, 2006-2013

2006-2008| Poorest | 2nd | 3rd | 4th | 5th | 6th | 7th | 8th | 9th | Richest |

|---|---|---|---|---|---|---|---|---|---|

| -9.5% | -0.2% | -1.0% | 2.2% | 2.9% | 0.5% | 1.2% | 4.1% | -3.7% | -4.2% |

| Poorest | 2nd | 3rd | 4th | 5th | 6th | 7th | 8th | 9th | Richest |

|---|---|---|---|---|---|---|---|---|---|

| 21.6% | 9.5% | 1.8% | 1.6% | -1.4% | 2.0% | -1.9% | -2.2% | 2.0% | 1.9% |

| Poorest | 2nd | 3rd | 4th | 5th | 6th | 7th | 8th | 9th | Richest |

|---|---|---|---|---|---|---|---|---|---|

| -14.8% | -5.3% | -2.1% | -5.1% | -9.6% | -9.0% | -8.2% | -9.9% | -7.5% | -6.7% |

Incomes for the poorest were already falling prior to the crash. But in the immediate aftermath of the crash, real incomes after tax were held steady. It is the period since 2010 that has led to the steepest decline in post-tax real incomes.

The decline seems relatively fairly spread, although it is clear that the “squeezed middle” from 50-80% of the income distribution (£20,300-£36,000, roughly) has suffered the most.

Pay recovery for the richest

More troubling is the most recent period for which official data is available, 2012/13:

Changes in post-tax real income, 2011/12-2012/13

2011-13| Poorest | 2nd | 3rd | 4th | 5th | 6th | 7th | 8th | 9th | Richest |

|---|---|---|---|---|---|---|---|---|---|

| -14.8% | 0.1% | -0.9% | 3.4% | -2.2% | -3.3% | -1.8% | -1.9% | -1.0% | 3.9% |

Whilst the top 10% have seen a recovery in their earnings, the poorest 10% have suffered an exceptional, single-year, fall in their real income of 14.8% as prices rise and welfare cuts come into effect.